do closed end funds have liquidity risk

When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. The value of a CEF can decrease due to movements in the overall financial markets.

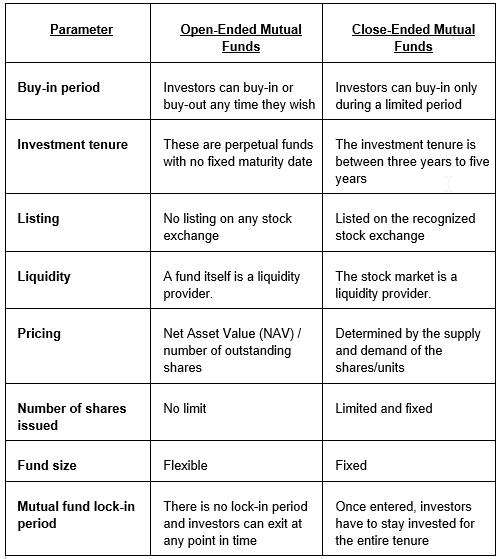

What Is The Difference Between Closed And Open Ended Funds Quora

Many of the newer funds have also seen a significantThe Closed-end funds CEFs sector is a small but diverse subset of investment products that has recently seen an increase in popularity.

. The NAV of a. The use of leverage allows the CEF to maintain a higher distribution yield than open-end mutual funds. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds usually mutual funds and unit investments trusts UITs.

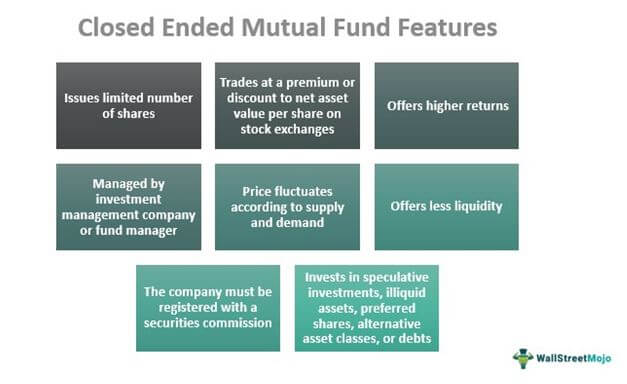

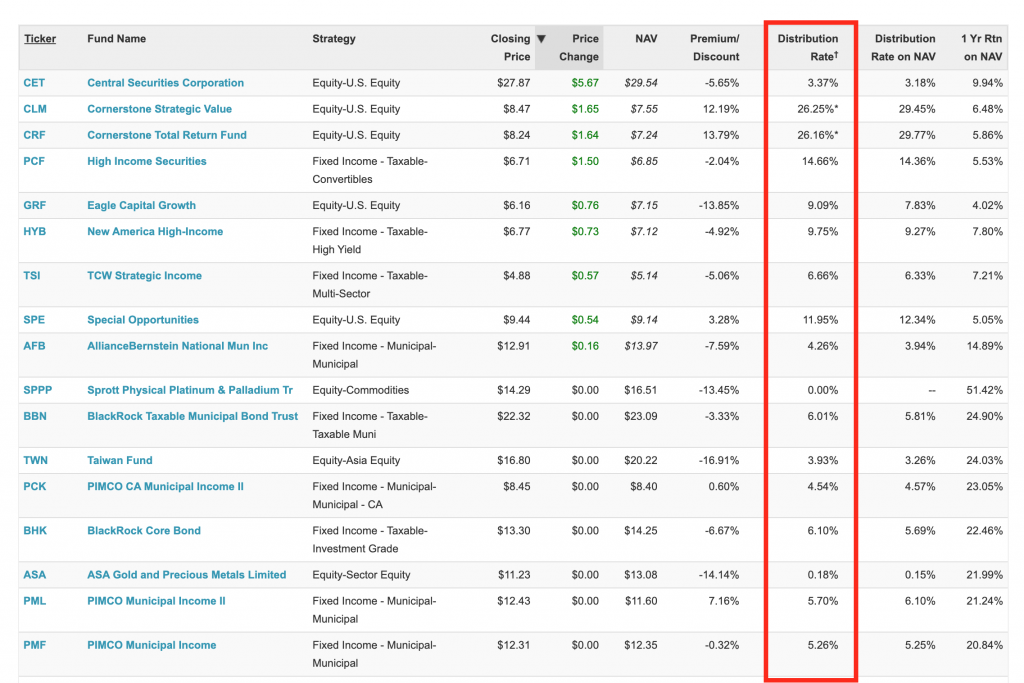

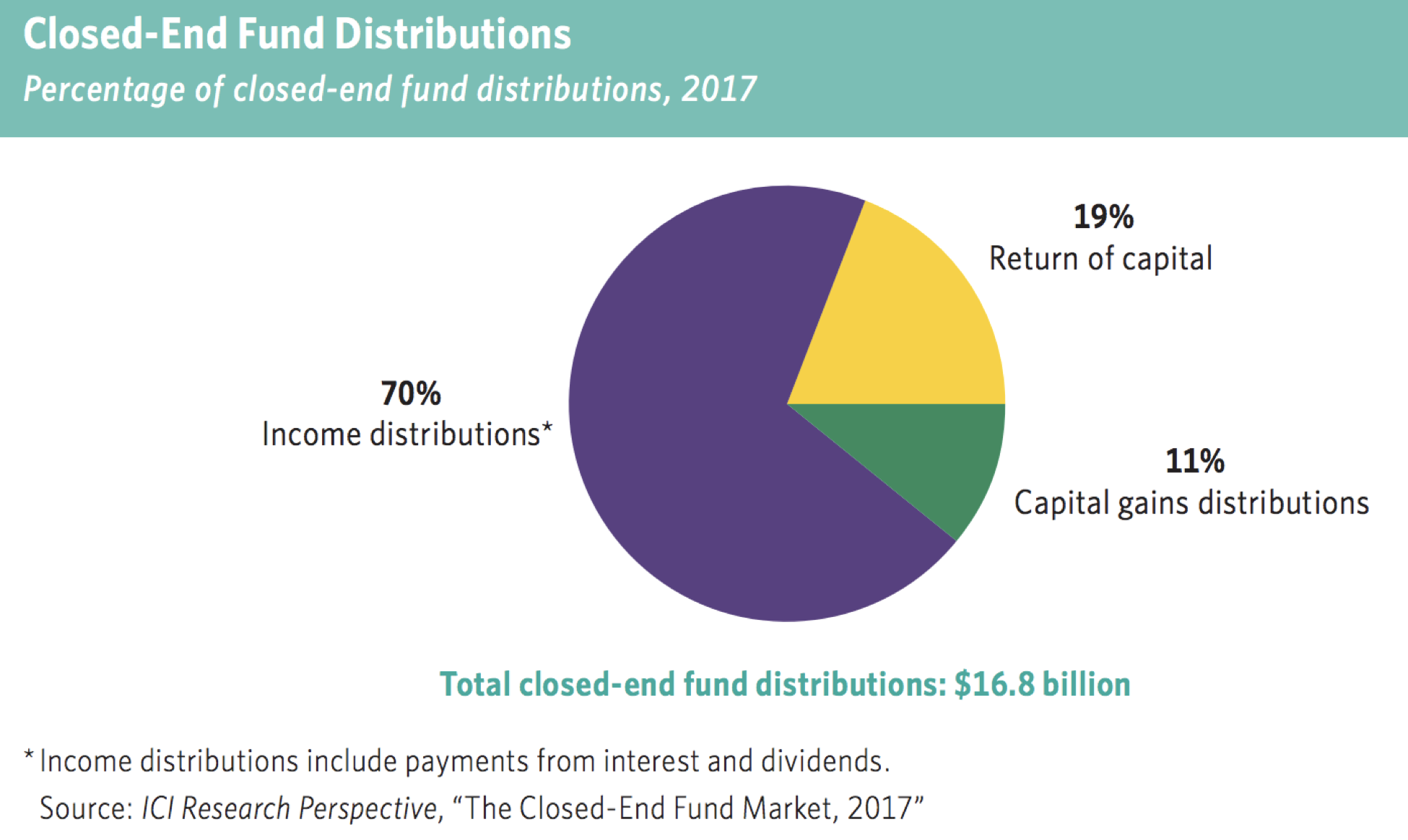

Ad Learn why mutual funds may not be tailored to meet your retirement needs. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Closed-end funds with managed distribution programs seek to pay a consistent dividend each month or quarter.

Although fund shares trade actively that doesnt affect the fund manager because no assets are flowing into or out of the portfolio. Like a mutual fund a closed-end fund is a pooled. Get this must-read guide if you are considering investing in mutual funds.

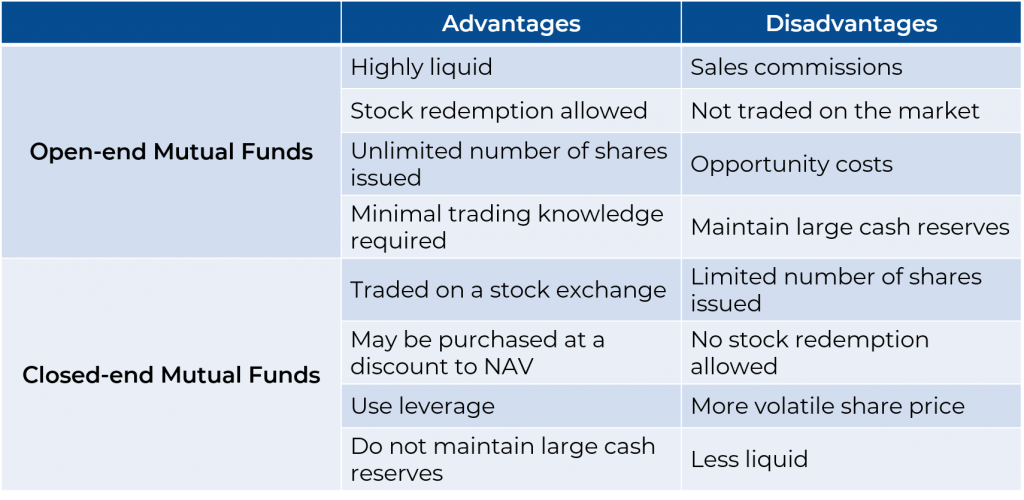

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio.

Just like open-ended funds closed-end funds are subject to market movements and volatility. This gives CEFs a relatively stable asset base which allows them to invest. Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in interest rates.

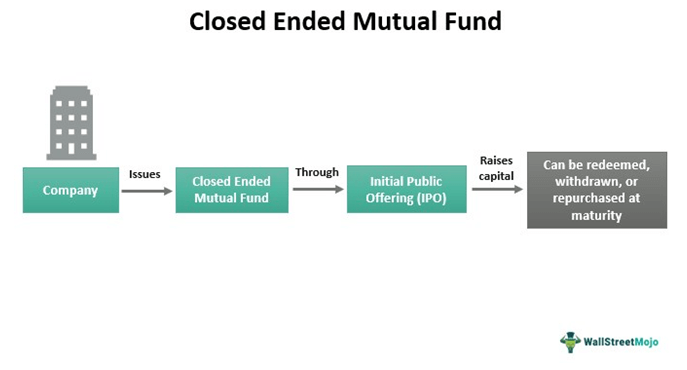

Closed-end funds by contrast are not continuously offered and have a fixed number of shares outstanding. The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while. Initial offering Like a company going public a closed-end fund will.

New SEC Rule Requires Open-End Funds to Have Formal Liquidity Risk Management Programs. Closed-end funds have stood the test of time for more than a century and have the potential to help savvy investors. The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio.

Unlisted closed-end funds also provide limited liquidity. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity.

Some closed-end funds have a managed distribution strategy. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Many closed-end funds have income distributions of 8 or more.

Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand. Closed-end funds CEFs can be one solution with yields averaging 673. Perceived primarily as income engines they can offer portfolio.

Changes in interest rate levels can directly impact income generated by a CEF. Closed-end funds often use leverage which can increase the funds volatility ie risk. Many of the newer funds have also seen a significant.

Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF according to Lipper Inc. Exchange-traded funds ETFs are generally also structured as open-end funds but can be structured as. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors.

Liquidity Risk Although CEFs are listed and traded on an exchange the degree of liquidity or ability to. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small percentage of shares. A risk specific to a closed-end fund is that its price can be substantially different from its net asset value.

This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders. Closed-end funds have the ability subject to strict regulatory limits to use leverage as part of their investment strategy. There is a one-time initial public offering IPO and with limited exceptions they are closed to new capital after the offering period hence closed.

In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade. Funds generally use leverage which makes them more volatile than open-end funds. However CEF discounts and leverage.

The Closed-end funds CEFs sector is a small but diverse subset of investment products that has recently seen an increase in popularity. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. This lack of liquidity is a real cost when buying and selling assets especially during times of market stress and efficient markets practitioners like Malkiel would suggest that the closed-end fund discount is the true cost of the liquidity of getting in and out of these funds.

Therefore closed-end fund managers can put capital to work in a long-term strategy without worrying whether their fund will have enough liquidity to pay back investors who suddenly sell redeem shares.

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Understanding Leverage In Closed End Funds Nuveen

Difference Between Open Ended Funds Vs Close Ended Funds

Types Of Mutual Funds Investing Mutuals Funds Safe Investments

Understanding Leverage In Closed End Funds Nuveen

Closed Ended Mutual Fund Meaning Examples Pros Cons

Understanding Leverage In Closed End Funds Nuveen

Closed End Funds Calamos Investments

Closed End Fund Definition Examples How It Works

What Are Mutual Funds 365 Financial Analyst

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Investing In Closed End Funds Nuveen

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed End Funds Definition Pros Cons Seeking Alpha

What Are Open And Close Ended Mutual Fund Schemes I Answer 4 U